IRR vs NPV: comparing investment options

Definition

(1) IRR stands for Internal Rate of Return, which a financial metric used to evaluate the profitability of an investment by calculating the rate of return it is expected to generate. The IRR represents the discount rate at which the net present value (NPV) of cash flows from investment becomes zero.

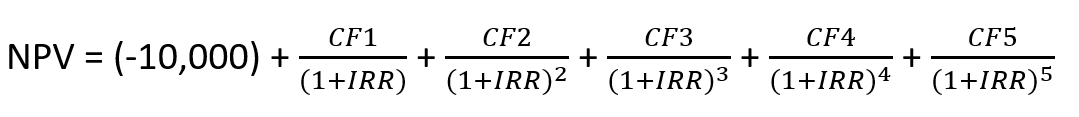

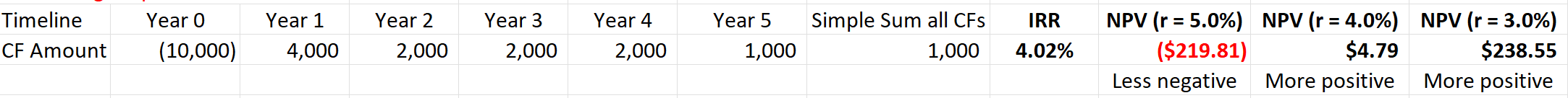

Let’s look at a 5-year investment where the cashflow outlays consist of an initial investment of $10k in year 0 and a series of positive cashflows from year 1 to year 5

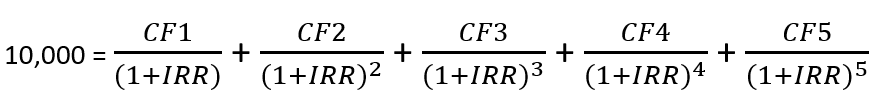

When setting NPV to zero to calculate IRR, we get:

Thus, in simpler terms, the IRR is the rate of return at which the sum of future cash inflows from an investment equals the sum of cash outflows at the beginning, which can also be understood as the return rate required for (discounted) cashflow breakeven.

A higher IRR indicates a more favorable investment since it suggests a higher rate of return.

To calculate the IRR, cash flows from an investment are discounted back to their present value using the IRR as the discount rate. The discount rate is adjusted iteratively until the NPV of the investment becomes zero, at which point the IRR is found.

(2) NPV stands for Net Present Value, which is a financial metric used to assess the profitability of an investment by considering the time value of money. The NPV represents the difference between the present value of cash Inflows and the present value of cash Outflows over a specific time period.

The NPV calculation involves discounting future cash flows back to their present value using a specified discount rate. The discount rate reflects the rate of return required by the investor, which takes into account factors such as the risk level, inflation, and alternative investment opportunities. The present value of each cash flow is then summed up to determine the overall NPV.

A higher NPV indicates a more favorable investment since it suggests a higher absolute dollar return.

If the NPV is positive, it suggests that the investment is expected to generate returns higher than the discount rate and may be considered financially viable. Conversely, a negative NPV indicates that the investment is projected to have returns lower than the discount rate, potentially making it an unprofitable venture.

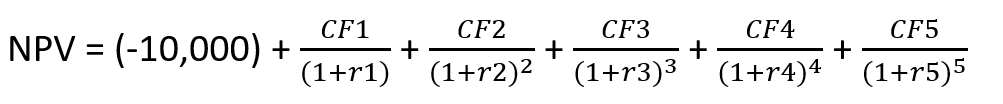

Using the same example above, we can see that the main difference between IRR and NPV is that there is only ONE discount rate in IRR calculation, which is (1+ IRR), while in NPV calculation, each year can have its own varying discount rates, which is (1 + r1), (1 + r2), (1 + r3), (1 + r4), (1 + r5). This is an advantage of NPV as we move to compare decision recommended by these 2 criteria in different investment scenarios.

IRR vs NPV in different investment scenarios

1. Higher positive Cashflow earlier vs later

Option 1: Higher positive CF later: assume Year 5 is $3k, higher than all prior years

Option 2: Higher positive CF earlier: assume Year 1 is $4k, higher than all following years

We can see that given the same initial investment and equal simple sum of all CFs, project with higher inflow earlier in the investment horizon will have higher IRR. This is because higher IRR makes denominators larger, which is needed to “offset” a larger numerator in Year 1 to equate the whole inflow to the same initial outflow.

We can also see NPVs for all 3 discount rate scenarios are higher in case 2 than in case 1. This is due to the fact that denominators in earlier year are smaller than in later years: year 1 denominator of (1 + r) < year 5 denominator of ( 1+ r)^5, which lead to higher NPV for earlier cash inflow than later cash inflow.

In this case, IRR is in agreement with NPV. Both will favor Option 2.

Another important observation to make is that since IRR is essentially the CF breakeven rate (rate that makes NPV = 0), when calculating NPV using discount rate higher than IRR, we will get negative NPV vs when using discount rate lower than IRR, we will get positive NPV. Thus, by comparing IRR to a hurdle rate/discount rate intended to use for NPV calculation, we can tell whether NPV will be positive or negative even before calculation.

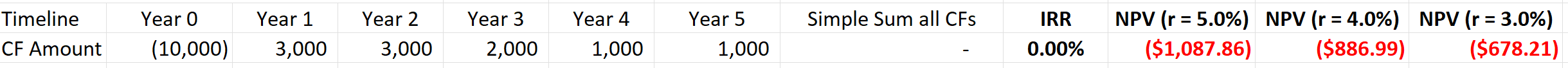

A super easy example to understand IRR intuitively is to look at case of IRR = 0, which is when simple sum of all CFs is zero (of course a bad investment example)

2. SAME NPV - Choose project with higher Irr

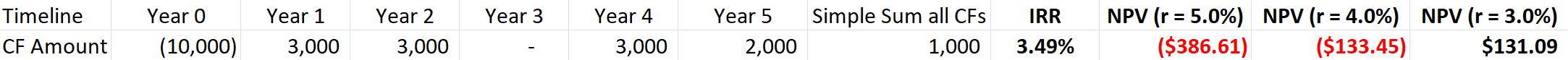

Option 3:

Option 4: Higher simple CF sum but lower IRR, same NPV

If interest rates are 5% or 4%, both IRR and NPV will recommend Option 3 (higher IRR and higher/less negative NPV).

If interest rate is 3%, since NPV for 2 options are the same, we choose project with higher IRR as it has higher positive cashflow coming in earlier. Time Value of Money is a critical factor here that discourages looking the total net dollars across all 5 years, called “simple sum all CFs” in these examples.

3. Same IRR - Chose project with higher npv

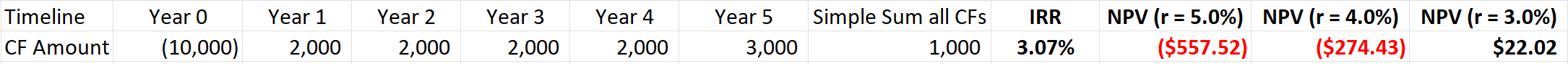

Option 1:

Option 5: all cashflow amounts are half the size of Option 1

It’s easy to see that given the same IRR of 3.07%, Option 1 gives higher NPV for all discount rate cases (NPV Option 1 is 2x NPV Option 5 to be exact). This reflects the fact that Option 5 initial investment is half the size of Option 1 initial investment, and so is the cash inflow each year. Put simply, NPV accounts for the magnitude of dollar investment. It measures return in (discounted) absolute dollar amount.

Of course, the other argument here is that if you only have $5k to invest, Option 1 is not even possible, assuming no financing option is available.

4. contradicting irr vs Npv - go with npv

Option 6:

Option 7:

We can see that IRR can NPV when r = 5% will recommend Option 7 but NPV when r = 4% and r = 3% will recommend Option 6. This means that in the case of lower interest rates, IRR and NPV disagree with regards to investment recommendations: IRR recommends Option 6 vs NPV recommends Option 7.

This conflict is due to the fact that the simple sum of CF outlays (ignore any compound factors) in Option 6 is greater than that of Option 7, meaning that NPV takes into account not only the timing of CF outlay but also the size of each payment and total cashflow in absolute dollar terms. IRR, on the other hand, prefers investment option with higher CF inflows in earlier years.

When NPV and IRR shows conflicting recommendations, NPV is my priority choice as

it is the absolute dollar value

it takes into account the effects of uneven CF stream in different periods and simple sum of all CF outlays

it can accommodate different interest rates in different periods

When evaluating a company, DCF method calculates NPV of all future Cash Flows as investors want to know how much free cash flow a company can generate and different re-investment options to put that cash to work.

IRR and Payback Period are additional metrics to consider in addition to NPV as they offer new/different perspectives.