this is part II of a project to scrape and analyze financial data to answer question of how different saas firms achieve Rule of 40

Part I is in “Automate Boring Stuffs” folder: https://www.eliza-bui.com/automate-boring-stuffs/python-scrape-rule-of-40

Rule of 40 = Revenue Growth Rate (%) + EBITDA Margin (%)

There are 3 main ways to achieve a score of 40% or more when combining YoY Revenue Growth Rate and EBITDA Margin

Lean heavily on high Revenue Growth

Lean heavily on strong EBITDA Margin

Solve for both double-digit Revenue Growth and consistent EBITDA Margin

In this blog post, we will look at the actual historical data for 5 stocks to see how different SaaS firms chart their ways to the high-performance club of “Rule of 40” and even “Rule of 50”

Special Note: I have noticed that some tickers don’t have accurate financial data when comparing the results scraped from Alpha Vantage to 10-Q or 10-K filings. I emailed Alpha Vantage about those discrepancies. Thus, readers should only view charts and tables below to understand the “big picture”, not to trust every single data point scraped from the internet.

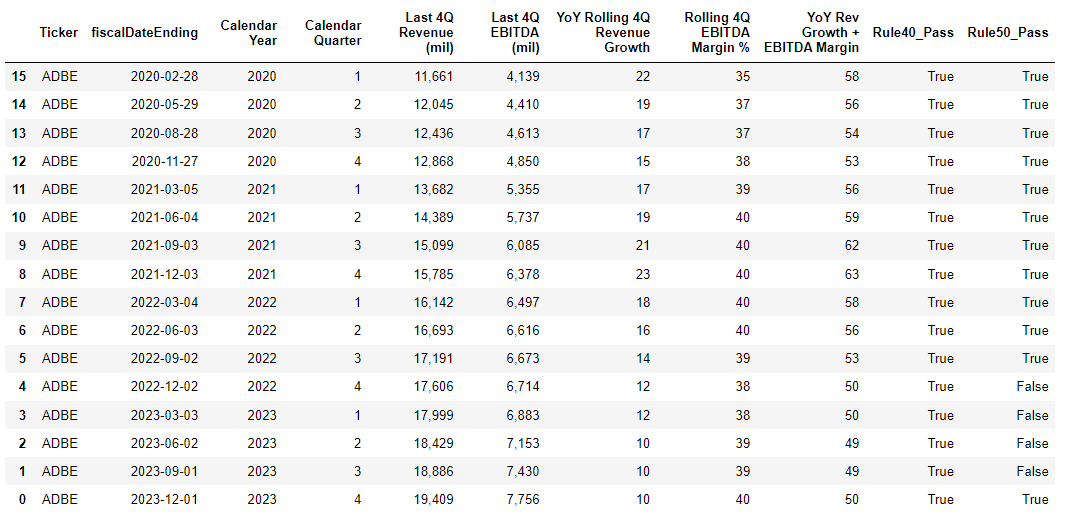

1.story of ADBE: Rely on strong and consistent EBITDA Margin while Revenue Growth slows down

ADBE not only passes Rule of 40 (applied to rolling 4Qs Revenue & EBITDA) in all quarters 2020-2023 but also achieves Rule of 50 in all said quarters (Q2-Q3 of 2023 is a bit above 49% but could be considered 50% for all intents and purposes)

Since 2020, ADBE YoY Revenue growth has slowed down from 20% to 10%, but due to consistently strong EBITDA performance in the 40% range, ADBE consistently passes Rule of 40 and Rule of 50. In other words, strong EBITDA Margin accounts for 70%-80% of ADBE's success in achieving Rule of 50 Accolate

2. story of FICO: Rely exclusively on EBITDA Margin while Revenue Growth dips negative (shortly)

FICO had EBITDA Margin consistently improved from 25% in 2020 to 46% in 2023

This strong margin improvement helps FICO achieve Rule of 40 in 2021 and Q1 2023 even though revenue growth significantly slowed down overtime to low single digit, and even dipped to (-4%) in Q1 2023

3. story of CRM: Rely half - half on Revenue Growth and EBITDA Margin

CRM passed Rule of 40 between Q2 2020 and Q2 2022, and especially passed Rule of 50 between Q3 2020 and 2021, with Revenue growth and EBITDA each contributing roughly half and half to its impressive performance

From Q3 2022, YoY revenue growth started to decelarate from 20% to 10%. That combined with EBITDA margin declined from 20%+ range in pre-2022 period to 15% moving into 2023 caused CRM to fail Rule of 40.

With layoff decision to cut cost in 2023, EBITDA margin improved to 23% in the LTM leading to Oct 2023, yet with YoY growth at 10%, CRM still fails Rule of 40

4. story of DDOG: Rely exlusively on Revenue Growth with essentially zero EBITDA Margin

DDOG achieves both Rule of 40 and Rule of 50 from 2020 to Q1 2023, almost exclusively due to hyper YoY revenue growth, while EBITDA Margin hovers in the low single digit rate

In Q2 and Q3 of 2023, LTM revenue growth slows down from 50%+ to 40% and then 32%, while LTM EBITDA Marign slightly dips to negative territory, pushing DDOG out of "Rule of 40" and "Rule of 50" fancy clubs

5. story of SNOW: Rely exclusively on Revenue Growth with negative EBITDA Margin

SNOW becomes IPO in Sep 2020 so Last Twelve Month or Trailing 4 Quarters data is not available unitl Q3 2021. Since its IPO, YoY Revenue Growth rate has been in the "super growth" club (>=50% YoY), although growth has consitently normalized/slowed down as the denominator grows larger each day. YoY Revenue growth for Trailing 4Qs ending in Oct 2023 of 41% is the lowest number since IPO, YET still an impressive number and a dream for many SaaS firms

Due to its growth mode, EBITDA margin is still in the negative territory by a significant amount, albeit an improvement in 2023 compared to 2020

SNOW passes Rule of 40 for all quarters of 2022 and passed Rule of 50 for the first 3 quarters of 2022 due to 90% YoY Revenue Growth balancing out with 40% EBITDA Margin

Marching into 2023, YoY Revenue growth slows down much faster than previous periods while EBITDA stops at around -37%, meaning that the improvement in EBITDA Margin is too small to offset the fast decline in YoY Revenue growth

So, “All roads lead to Rome” right? Then what lesson are we learning from these real-life examples?

Business leaders who believe in “Rule of 40” will try to manage their business towards this goal, adjusting expenses/investments based on their firm’s growth stage and general macro-economic conditions. They should set realistic revenue growth targets within their existing portfolio for a 2-5 year horizon and steer their operations to stay within the 40% framework. For example, a $500 million SaaS company, after reaching 20%+ annual revenue growth as an industry leader for years, and now starts to see its revenue growth slow down to 10% (due to its products fully penetrating TAM), will start adjusting its cost structure to boost EBITDA margin by 10 percentage points over two years to maintain Rule of 40 balance. In order to stop revenue growth from declining, firms will need to fund investments in new, high-growth ventures.